Fintech App Engagement Examples: 15 Patterns That Work (and Why)

- Amar Rawat

- Jan 28

- 11 min read

Updated: Jan 29

Table of Content

How to apply these patterns without turning your app into spam

Practical implementation approach (two core actions + top failure states)

Most fintech “engagement examples” articles are useless because they confuse activity with value. They celebrate clever nudges, shiny gamification, or aggressive notification tactics without asking the only question that matters: did the user complete a high-stakes financial job with more confidence and less friction?

This article does the opposite. These 15 engagement patterns work because they reduce uncertainty, increase successful completion of core actions, and preserve trust. They are not “growth hacks.” They are product patterns that make fintech feel reliable.

To keep this practical, each pattern follows the same logic: the situation that triggers it, what the product does, why it works, what to measure, and what to avoid so you don’t turn a good pattern into spam or risk.

How to judge whether a fintech engagement pattern is actually good

Good fintech engagement moves users through a state, not toward a notification

In fintech, users rarely need “more reasons to open the app.” They need clarity about what state they’re in and what action to take next. The best engagement patterns are state-aware and outcome-driven. They show the user what’s happening, what’s next, and how to complete the job safely.

Good fintech engagement reduces support, retries, and anxiety

If a pattern increases opens but also increases retries, complaints, or opt-outs, it’s not working. It’s generating noise. You should judge patterns by whether they improve completion, reduce friction, and preserve trust signals.

Fintech engagement patterns at a glance

Pattern | Trigger Example | Core Impact | Trust Signal | Risk Level |

Single Source Receipt | Payment complete | Reduces repeated status-checking | Fewer disputes and “missing payment” complaints | Low |

Pending Timelines | Transfer pending | Reduces anxiety-driven app opens | Fewer support contacts about pending transactions | Low |

Failure Recovery | Payment failed | Reduces retry loops and repeated attempts | Higher successful recovery without escalation | Low |

One-Tap Repeat | Bill pay repeat | Increases repeat usage of the core action | Error rates remain stable (no increase in mis-sends) | Medium |

Resume Onboarding | Setup abandoned | Improves onboarding completion rate | Fewer duplicate submissions and fewer “stuck” users | Low |

Progressive Disclosure | Fee commitment | Reduces drop-offs at decision points | Fewer complaints about fees, limits, or surprises | Low |

Preference Center | Messaging received | Keeps opt-outs and fatigue under control | Better long-term trust and lower uninstall risk | Low |

Explain Why Verification | ID requested | Improves verification completion rate | Lower abandonment due to “why do you need this?” concerns | Low |

Panic-Reduction Confirm | Transfer done | Reduces repeat checking after completion | Fewer post-transaction support contacts | Low |

Autopay Engine | Repayment repeat | Builds predictable repeat behavior | Fewer missed payments and late-payment escalations | Medium |

Next Best Action | First transfer | Increases second and third core-action completions | Less friction in the next step of the journey | Low |

Dispute Tracking | Issue reported | Improves resolution follow-through | Lower churn after disputes and fewer repeat contacts | Medium |

Lifecycle Education | Paycheck deposit | Improves education-to-action conversion | Opt-outs stay stable because content is relevant | Low |

Risk Friction | New beneficiary | Improves completion of high-risk actions safely | Fewer false positives and fewer unfair blocks | High |

Release Adjustments | Provider incident | Reduces incident-driven retries and confusion | Faster recovery and fewer escalations during incidents | Medium |

Now lets discuss the patterns individually

The “single source of truth” transaction receipt

When it triggers

Any time a payment, transfer, deposit, withdrawal, or repayment completes.

What it does

The product generates a clear, stable receipt screen and history entry that includes a timestamp, reference ID, method, parties, status, and expected settlement behavior if relevant. It is easy to share for proof, and easy to find later.

Why it works

Users reopen fintech apps to confirm reality. A trustworthy receipt reduces repeat checking, reduces disputes, and makes the app feel dependable. This pattern is engagement because it increases future successful usage by reducing uncertainty.

What to measure

Receipt view rate after completion, repeat status checks within 10 minutes, support contacts about “did it go through,” and dispute initiation rates.

\What to avoid

Receipts that change wording over time, missing reference IDs, or hiding key details behind extra taps.

Pending-state timelines with an explicit “next update” promise

When it triggers

Any time an action enters a pending state (verification pending, transfer pending, claim under review).

What it does

Instead of a vague “pending,” the product shows what pending means, what the system is waiting on, and when the user can expect the next meaningful update. If user action is required, it is explicit.

Why it works

“Pending” is where trust goes to die. This pattern reduces anxiety-driven opens and prevents users from retrying actions that make things worse.

What to measure

Pending duration distribution, repeat opens during pending, retry attempts during pending, and support contacts.

What to avoid

Fake promises (“will complete soon”) and timelines you can’t meet. If you can’t predict, be honest and explain the dependency.

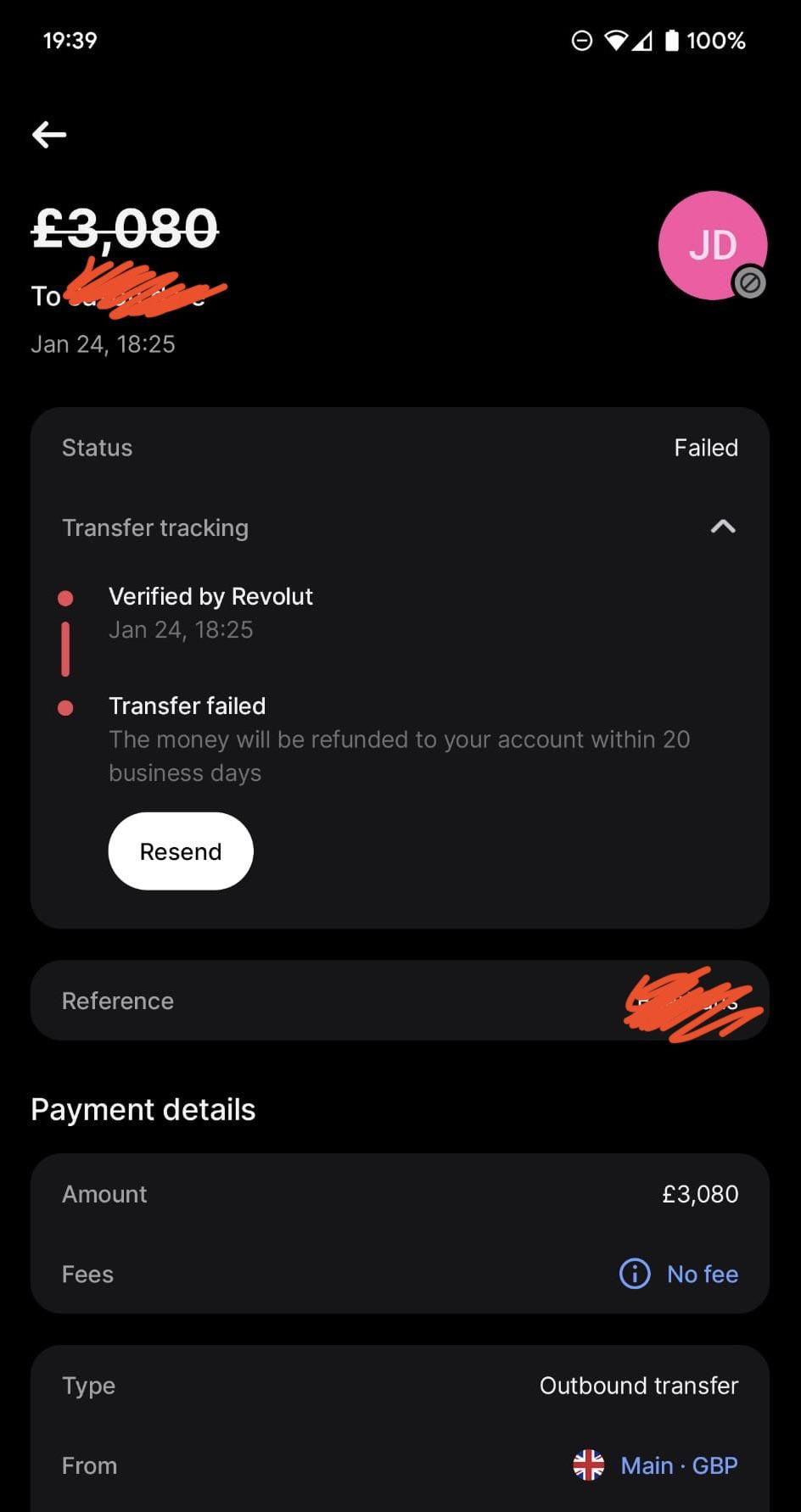

Failure recovery that tells users what not to do

When it triggers

Any failed payment/transfer/authorization or any failed verification step.

What it does

The product explains the failure in plain language, gives a next best action, and explicitly warns against harmful retries when appropriate. It also offers a fast path to resolution (alternative method, later retry, or support escalation with context).

Why it works

Users default to panic behavior in money flows. They retry, they spam buttons, they change details randomly. Clear “don’t do this” guidance prevents compounding errors and reduces downstream disputes.

What to measure

Retry loop frequency, successful recovery rate, time-to-recovery, and support contacts per failure.

to avoid

Generic error codes, blame-shifting language, or “try again later” without context.

“One-tap repeat” for trusted, repeatable actions

When it triggers

When a user repeats the same action regularly: paying a bill, transferring to a known recipient, topping up, making a repayment.

What it does

The product surfaces a safe, one-tap repeat action with pre-filled details, plus a review step appropriate to risk (amount, recipient, method). It makes the happy path fast while keeping a confirmation that prevents accidental transfers.

Why it works

The biggest driver of engagement is making the core action easy to repeat. Convenience creates habit, especially for predictable, recurring jobs.

What to measure

Repeat rate of core action, time-to-complete, and error rates on repeat flows versus manual flows.

What to avoid

One-tap actions without safeguards for amount/recipient confirmation. Speed without control is a trust leak.

Smart “resume where you left off” onboarding

When it triggers

When onboarding includes multi-step verification, linking, funding, or setup that users abandon mid-way.

What it does

The product saves progress, returns the user to the exact step with context, and removes redundant steps. It also explains what was completed and what remains.

Why it works

Most fintech drop-off happens during setup. Users don’t abandon because they hate your app; they abandon because the process is exhausting or confusing. Resuming reduces the psychological cost of returning.

What to measure

Onboarding completion rate, time-to-first-value, reactivation rate of incomplete onboarding users, and duplicate document submissions.

What to avoid

Restarting users from step one, or losing progress because the app treats state as “session-only.”

Progressive disclosure of trust-critical information at decision moments

When it triggers

When users are about to commit to fees, limits, timing, interest, penalties, or risk.

What it does

Instead of hiding important information in long documents, the product surfaces the relevant facts at the moment of choice, in plain language, with links to detail for those who want it.

Why it works

Users don’t read policy pages. They do, however, remember surprises. Surfacing the right information at the right moment prevents churn, disputes, and complaints later.

What to measure

Drop-offs at decision points, dispute/complaint reasons tied to “fees/limits,” and post-transaction satisfaction.

What to avoid

Burying terms until after commitment. That might convert today and destroy trust tomorrow.

A preference center that actually governs messaging

When it triggers

When users receive any non-essential messages, and ideally during onboarding.

What it does

The product lets users control what they receive (transactional, security, educational, promotional), how often, and through which channels. It enforces those preferences reliably.

Why it works

In fintech, messaging is sensitive. Giving users control increases long-term engagement because it prevents fatigue and protects trust.

What to measure

Opt-in and opt-out rates, message-driven completions, uninstalls after campaigns, and spam reports.

What to avoid

A preference center that exists but isn’t honored. That is worse than not having one because it signals dishonesty.

“Explain the why” for verification and data requests

When it triggers

Any time you ask for identity documents, biometric checks, bank linking, or permissions.

What it does

The product explains why the data is needed, what it enables, how it is protected, and what happens if the user doesn’t complete it. It also shows progress and expected review time if applicable.

Why it works

People abandon fintech onboarding when it feels invasive or endless. Explaining “why” turns friction into trust-building.

What to measure

Drop-off at verification prompts, completion rate by step, time-in-step, and support questions about “why do you need this?”

What to avoid

Vague language (“for your safety”) without specifics, or requesting permissions that are not clearly connected to value.

Confirmation messages that reduce panic, not increase it

When it triggers

After high-stakes actions: transfers, repayments, claims, card freezes, password changes.

What it does

The product confirms what happened, what changes, and what the user should do next (usually nothing). If the system is processing, it clearly states that processing is underway and where to track it.

Why it works

Fintech users fear silent failures. Clear confirmations reduce obsessive checking and prevent unnecessary support outreach.

What to measure

Repeat opens immediately after the action, “status check” frequency, and support contacts post-action.

What to avoid

Ambiguous confirmations like “submitted” without telling the user whether money moved yet.

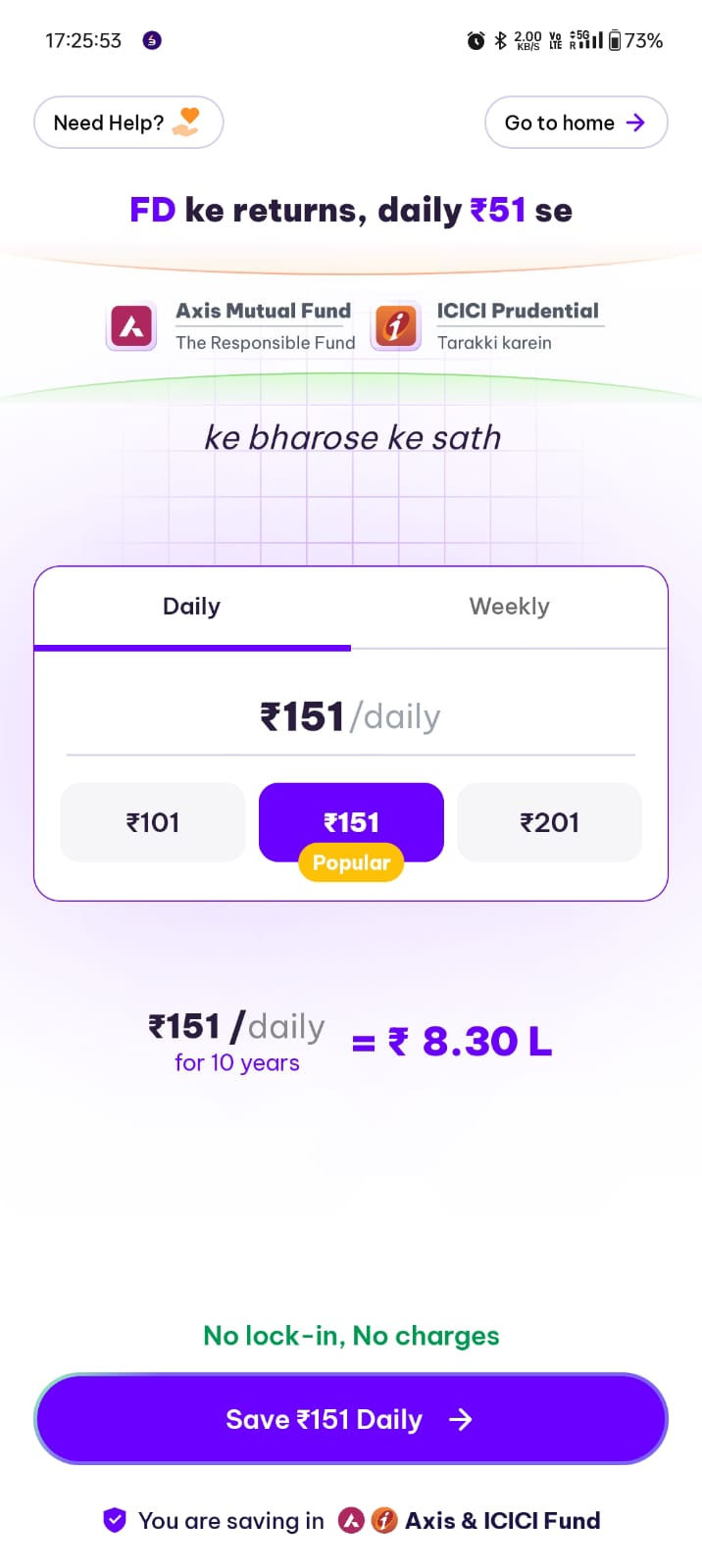

Autopay and recurring plans as engagement engines

When it triggers

When a user repeats payments, repayments, or investments.

What it does

The product offers a recurring option at the moment repeat intent is clear, explains how it works, and provides controls (pause, change, cancel) with reminders that aren’t manipulative.

Why it works

Recurring behavior is the cleanest form of engagement because it creates predictable value without constant prompting. It also reduces missed payments and last-minute panic.

What to measure

Autopay adoption, autopay success rates, cancellation reasons, and impact on retention and support volume.

What to avoid

Making cancellation hard or hiding controls. That turns a helpful feature into a trust violation.

“Next best action” based on state, not based on marketing

When it triggers

When a user completes an action or reaches a new state (e.g., first transfer completed, first repayment done, first claim submitted).

What it does

The product suggests a state-appropriate next step that genuinely helps the user, such as saving a beneficiary, setting a reminder, enabling autopay, or learning how disputes work. It is not a random cross-sell.

Why it works

Users are most receptive immediately after successful completion. A helpful next step improves repeat usage and reduces future friction.

What to measure

Next-action adoption, repeat core action rates, and downstream drop-offs.

What to avoid

Cross-selling before trust is earned, or suggesting irrelevant actions that signal you don’t understand user intent.

Calm, transparent dispute and resolution

When it triggers

When a user reports a problem: failed transfer, missing refund, merchant dispute, claim escalation.

What it does

The product provides a clear case timeline, required steps, expected updates, and a way to submit information without repeating the story. It makes escalation predictable.

Why it works

Resolution is part of engagement. Users don’t churn just because something went wrong; they churn because they feel abandoned and powerless. Transparent resolution increases trust and future usage.

What to measure

Time-to-resolution, repeat contacts per case, satisfaction after resolution, and churn after disputes.

What to avoid

Sending users into support channels without context, forcing them to re-explain repeatedly, or hiding status.

Seasonal and lifecycle education that leads directly to action

When it triggers

When there’s a predictable lifecycle event (first paycheck, first credit statement, first investment deposit, renewal window).

What it does

The product delivers short, relevant education tied to the user’s state and provides an immediate action path (set autopay, set a goal, fund an account, renew coverage).

Why it works

Education only drives engagement when it is timely and directly connected to a user action. Otherwise it’s content marketing inside an app.

What to measure

Education-to-action conversion, repeat rates, and opt-outs.

What to avoid

Long content dumps or generic advice that doesn’t connect to a next step.

Risk-aware friction that feels fair

When it triggers

When a user attempts a high-risk action (new device, new beneficiary, unusual amount, suspicious behavior patterns).

What it does

The product applies step-up verification and explains why in non-accusatory language. It keeps the user informed and provides a clear route to completion.

Why it works

Users tolerate friction when it feels justified and transparent. They churn when friction feels random or punitive. Fair risk friction preserves trust while preventing losses.

What to measure

Step-up pass rates, abandonment at step-up, false positives, and subsequent retention.

What to avoid

Silent blocks or vague “something went wrong” messaging for risk events.

Release-safe experience adjustments for state-critical screens

When it triggers

When you need to change critical guidance quickly: payment failures, verification requirements, policy changes, provider incidents.

What it does

The product can update copy, ordering, help surfaces, and recovery paths quickly without waiting for long release cycles, while keeping core logic secure and auditable.

Why it works

Fintech engagement breaks when user state and UI guidance drift apart. Fast, controlled updates prevent long periods of confusion and support spikes during incidents.

What to measure

Time-to-mitigate for incident-driven UX changes, reduction in retries and contacts during incidents, and completion recovery.

What to avoid

Uncontrolled changes without governance. Speed without auditability can create compliance and trust problems.

How to apply these patterns without turning your app into spam

The fastest way to ruin good patterns is to treat them as messaging tactics rather than product design. Most of the patterns above work even with minimal notifications because they reduce uncertainty inside the app itself. When you do use messaging, tie it to state and user intent, and judge it by outcomes and trust signals, not by opens.

A practical way to implement this is to pick two core actions, identify the top three failure states for each, and then apply patterns that make those states obvious and recoverable. If you make “pending,” “failed,” “needs verification,” and “under review” feel clear and controllable, you will see engagement improve without adding noise.

Summary: what actually works in fintech engagement

The engagement patterns that win in fintech are not the loudest. They are the ones that make the product feel reliable. They reduce retries, reduce support, reduce anxiety, and increase successful completion of core actions. If you use the 15 patterns above as a checklist and you measure them against outcomes and trust signals, you will build engagement that lasts instead of engagement that spikes and disappears.

FAQs

How do I choose the right engagement patterns for my fintech app?

Start with your core action (the one outcome you want repeated) and the three most common “failure states” that block it: verification stuck, transaction pending, and transaction failed are the usual suspects. Choose patterns that make those states clear and recoverable before you add any messaging-heavy patterns. If you cannot map a pattern to a specific state or outcome metric, it’s probably cosmetic.

Are push notifications necessary to improve fintech engagement?

Not for the fundamentals. The strongest patterns in the article work inside the product by reducing uncertainty and making actions repeatable. Notifications should be used primarily for transactional, security, and genuinely time-sensitive reminders and always with preferences, frequency caps, and suppression rules. If notifications drive opens but not completed core actions, you’re spamming, not engaging.

What metrics should I track to know these patterns are working?

Track core action completion and repeat rate first. Then track friction (drop-offs, retries, time-to-complete) and trust signals (failure rates, disputes/chargebacks where relevant, support contacts per active user, notification opt-outs, uninstall spikes after campaigns). If “engagement” increases but trust signals degrade, the pattern is hurting you.

Can these patterns increase risk or compliance exposure?

Yes, if you implement them carelessly. The risky version is when “engagement” becomes pressure like misleading urgency, unclear fees/limits, or messaging that reveals sensitive information. The safe version is state-aware UX, transparent disclosures at decision moments, preference-controlled messaging, and auditable change management for critical flows.

What’s the best way to implement these patterns without a big redesign?

Don’t start with a redesign. Start with the two highest-volume flows that matter most (usually money movement and onboarding/verification). Fix state clarity (receipt, pending, failure recovery), add “resume where you left off,” and implement preference-controlled messaging. These are surgical changes that usually move outcomes faster than a visual overhaul.

Comments